Feel that? That’s the seismic shift happening right now in the healthcare industry. Over the past twenty years, several distinct market trends have emerged across the healthcare landscape. Now, these trends have arrived – and they’re only gaining more traction.

The Affordable Care Act facilitated many of these changes, including an influx of digitally savvy customers hungry for education. And although its survival has recently been called into question by a new administration, the ACA’s impact will undeniably live on.

These conditions point to more than a shift in demographics and behavior. They also indicate a new model of healthcare consumerism: one that pivots away from a broker-driven B2B model and more toward a straight DTC model.

If this seems like déjà vu, it’s because the same shift occurred in the property and casualty (P&C) insurance industry just a few decades ago, with auto insurance sales leading the way.

The consumer largely drives this new dynamic in the healthcare industry. So to understand the DTC shift in the healthcare industry, let’s start by understanding the modern healthcare customer.

What does the modern healthcare customer look like?

To start, they’re technologically savvy.

Healthcare customers don’t just understand technology, they prefer it. This means they tend to have less patience for processes that lack a technological edge. They’re getting more information, from more places, in less time. Are you keeping up?

In a snapshot, today’s healthcare consumer is…

Always connected. They’re using multiple devices and channels, often at the same time.

Socially minded. They’re using social channels for gleaning insights and reviews from family, friends, and experts.

Knowledgeable. They’re independently educated with content available to them 24/7 (and they’re also in-tune with your competitors).

Experiential. They’re expecting a personalized experience, and one that will knock their socks off.

The modern consumer is looking for (and finding) content primarily on digital channels. If you want to reach them, you must do so online. In fact, of today’s healthcare consumers…

67% are interested in being offered insurance via mobile.

48% regard product advice on social media as important.

54% use mobile phone apps for the purpose of health monitoring.

As healthcare consumers become more and more technologically savvy, they become more accountable for their healthcare decisions. Consumers are moving beyond “sick care” and toward an overall health and wellness agenda. It’s an opportunity for healthcare organizations to facilitate their goals and establish trust with new and existing customers.

So by using technology to stay connected, simplify healthcare processes, and provide a way to help people monitor their health, healthcare companies can attract and retain this emerging class of healthcare consumers.

After all, this is a familiar trend – one that occurred even earlier in the auto insurance industry.

The auto and health insurance parallel: The same trends repeat themselves

In the early 2000s, about 80% of personal automobile insurance policies were placed through a broker. But as consumers shifted toward online shopping and insurance agencies moved toward a DTC sales model, dynamics started to change.

Between 1995 and 2011, the overall number of P&C insurance agents declined by 10%. Even more illuminating, P&C insurance carriers increased their marketing spend from $1.7 billion in 2002 to $5.9 billion in 2011.

These growing investments have moved the focus away from individual agents and toward the carrier brand. So when asked, “Who is your insurance carrier?” a policy holder will now likely respond with a brand name over an agent’s.

Today, auto insurance providers continue to spend more to reach customers through multiple channels. And there’s no better case study to demonstrate this shift than the P&C insurance giant, GEICO.

In 2010, GEICO became the first auto insurance organization to provide mobile users with the ability to quote and buy a policy right on their smartphones. More recently, GEICO was the lead sponsor for Amazon’s new original content streaming service.

Translation: GEICO is evolving to fit their consumer’s lifestyle. And by doing so, the industry pioneer has actually overtaken Allstate in premium sales.

That’s a tremendous shift in the auto insurance industry – one that could soon be replicated in other industries, like health insurance.

Who will be the breakout player in the health insurance industry?

While the health insurance industry has yet to match the dramatic transformation seen in the auto insurance space, it’s trending in that direction.

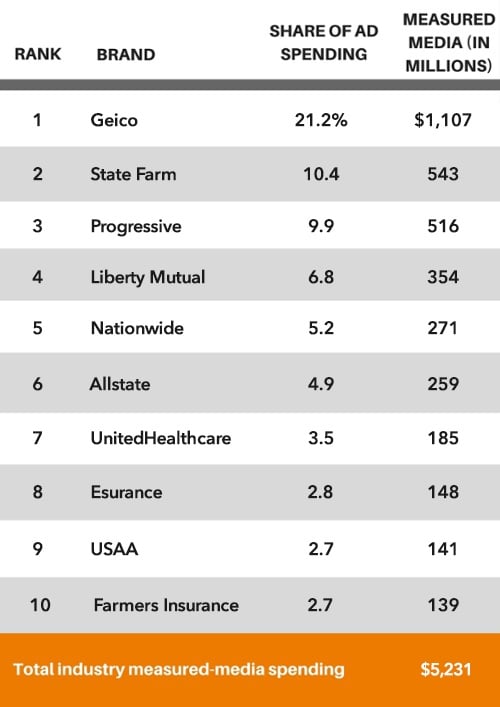

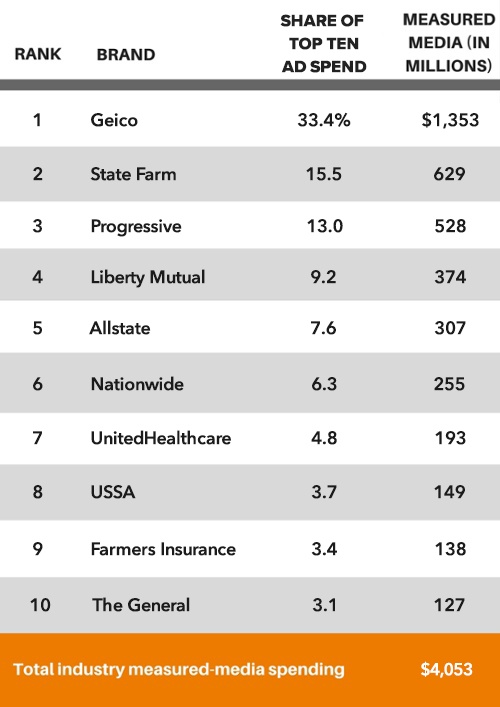

In 2014, only one health insurance provider found its way on the list of insurance companies with the highest share of media spend. Coming in at number nine, UnitedHealthcare was that organization, but it trailed significantly behind top P&C insurance carriers.

Fast-forward a couple years, and UnitedHealthcare still stood as the lone health insurance industry provider on the list. Yet this time, it had climbed to number seven, increasing its media spend by over $30 million.

Share of insurance industry U.S. measured-media spending

2014

| 2015

| 2016

|

Will UnitedHealthcare’s spending trigger other health insurance providers to spend more on marketing to the modern consumer? Only time will tell.

There’s ground yet to be covered, but the parallel between the auto and health insurance industries evolutions is undeniable.

Making up the gap

As demonstrated, the healthcare industry is not the only industry affected by this fundamental market shift; it’s just one of the slowest to react.

Of all surveyed industries, the following percentage of respondents agreed they are developing new applications, features, and processes to cater to new generations of customers:

- Healthcare – 61%

- Travel – 64%

- Telecom – 74%

- Retail – 76%

- Financial Services – 73%

A major gap exists between what consumers want from health insurance providers, and what they can actually offer them.

To reach today’s healthcare audience, companies need to cater their outreach to the digital-savvy consumer who’s searching for tools to interact and educate themselves with.

If the classic mantra “Be Where the Customer Is” holds true, then organizations should expose these tools less to the broker, with whom the emerging consumer may be unfamiliar, and more toward the consumer themselves.

While not every customer will have a linear experience, brands should be prepared at every stage of the buyer’s journey. To help with this, we’ve compiled the questions here that marketers need to continually ask to stay in-tune with this new consumer.

Save this guide (we recommend keeping it right next to your desk) and use it as a self-assessment for your brand. As you navigate the new consumer-focused world of healthcare marketing, every bit of help counts.

This article was originally published in DTC Perspectives.